Prepaid card Skrill

Jetzt Handykarte im SIMon mobile-Onlineshop bestellen - Sauber. Mit bis zu 27 GB Daten und bereits ab mtl. 8,99 € im 5G-Netz surfen.

How to Withdraw from My Skrill Account

Eligible members get a free* Skrill Visa® Prepaid Card. Sending money to an e-mail or Skrill wallet? No transfer fee**, too. Select your country and local currency Deposit funds Withdraw funds Send money, Receive money Account levels fees Service Fee Currency conversion Prepaid card Local payment methods + fee: 0.00 % Global payment methods +

Skrill Prepaid Mastercard virtual card and Customer Benefits VipDeposits

The Skrill Virtual Prepaid Mastercard ® lets you use the funds in your Skrill wallet to make online purchases wherever Mastercard ® is accepted. Instantly add a virtual card to your wallet and start using your Skrill balance to make payments.* *Available in EUR to residents of countries in the European Economic Area (EEA)

Skrill Prepaid Mastercard virtual card and Customer Benefits VipDeposits

1. Open your Mobile Wallet 2. Add your Skrill Card by taking a photo or entering your card details 3. You're ready to spend anywhere that supports contactless! Get started Get your free virtual card Instant Apply in seconds and start spending online Stay in control Avoid overspending and overdraft fees Flexible

Skrill Prepaid Mastercard virtual card and Customer Benefits VipDeposits

💸 - To try the WISE Platform: https://transferwise.prf.hn/l/7gpRQX1 Skrill Prepaid Physical Card: https://www.youtube.com/watch?v=iwimo4Ms6Ac Wise Tutoria.

Skrill Prepaid Mastercard virtual card and Customer Benefits VipDeposits

The only fees associated with the Skrill Prepaid Mastercard® is a €10 annual fee, 1.75% ATM usage fee, and 3.99% foreign exchange. However, these fees can be lowered by climbing the Skrill VIP tiers. Skrill Knect

Prepaid card Skrill

The Skrill Visa Prepaid Card is also the perfect solution for consumers with lower access to mainstream financial products.. (ATM networks may charge fees). The Skrill Visa Prepaid Card is also a strong financial solution for US consumers travelling internationally, with Visa accepted in over 200 countries and territories across the world..

Skrill Fees and Limits eWalletsReview

Skrill offers a prepaid Mastercard that can be used to withdraw money from ATMs or make purchases online or in-store. The fees for using the prepaid card include an annual fee, a fee for ATM withdrawals, and a fee for foreign currency transactions. Skrill Inactivity Fees

Skrill Prepaid Credit Card Where To Find The Best Skrill Deposit Bonus Grab The Best Deal Here

The Skrill Virtual Visa® Prepaid Card gives our customers all the benefits and access to eCommerce of a physical Visa® card with all the speed and convenience of a solution that is 100%.

Mastercard prépayée SKRILL Avantages et caractéristiques

US residents will pay less in fees than many other countries Skrill operates in. In short, US residents will only face one fee when sending money abroad through Skrill. Deposit funds: Free. Withdraw funds: Free. Send money, receive money: Both free. Currency conversion: 3.99% above the mid-market rate, or higher.

Skrill Prepaid Card Limits How Much Can You Spend?

The Skrill Visa ® Prepaid Card gives you quick access to your money at home or abroad, so you can spend easily and securely**. Get your free* card No new card application fee* No credit checks No bank account required Get a free Skrill card There are only three simple steps between you and your Skrill Visa ® Prepaid Card.

Tarjeta Skrill Virtual Visa Prepaid Skrill

What are Skrill's Fees? Skrill works in a multitude of countries and currencies and the fees can differ depending on where you are and what currency you use. To give you an idea of how much you can expect to pay in the United States, take a look at these USD rates for US customers:

Skrill Virtual Visa Prepaid Card Skrill

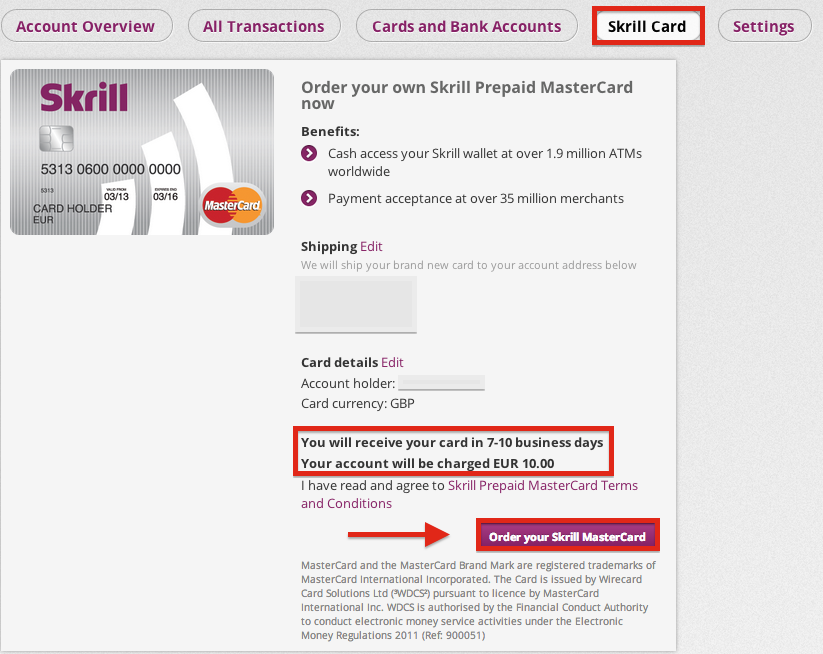

The Skrill Prepaid Mastercard® gives you instant access to your balance at home or abroad. Find out how it works and order your card.

Prepaid card Skrill

Receiving money into your Skrill account is free Select your country and local currency Deposit funds Withdraw funds Account level fees Send money, receive money Currency conversion Service Fee Prepaid card Buy and sell cryptocurrency Local payment methods fee: 0.00 % fee: 1.00 % fee: 2.50 % fee: 5.00 % Global payment methods fee: 1.00 %

Skrill Fees and limits Comparison [Updated 2023]

The Skrill prepaid mastercard has additional fees to consider.If you choose to get a prepaid card from Skrill, you'll have spending limits placed on it based on your account verification. You could be able to spend $25,000 per month, or you might be limited to just $135, depending on your situation.

Skrill Card Fees FX Changes 2020 • eWalletOptimizer

Skrill also offers the option of a prepaid Mastercard, which you can load up with funds and use to spend when you travel. What payment methods does Skrill accept? Skrill lets you top up your account and power your money transfers with all kinds of local and global payment methods. For UK users, the full list includes the following ⁵: Bank transfer